analysis | 2016-03-05

The real reasons why Nolito wasn't signed by Barcelona

The doubts surrounding the club's economical health continue, but what are the real issues? Are there issues at all?

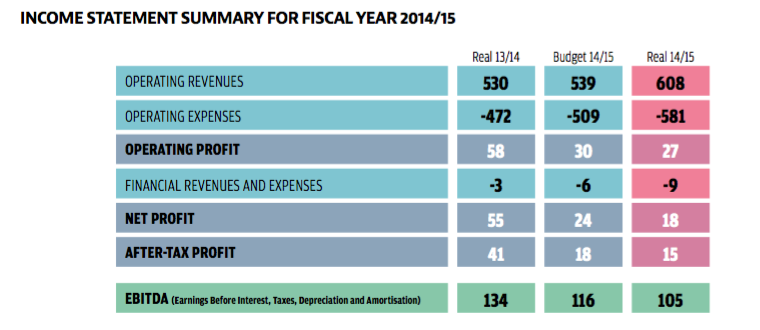

The 2014/2015 season was a complete one for a Barcelona side that managed to repeat what was thought impossible: led by Luis Enrique on the bench and Messi on the field, the blaugranas reached their second treble, unmatched achievement in the history of football. When, a few months later, the Board published the numbers for the season’s economical closure, it seemed like sporting joys had their influence in the accountings that showed a new record in earnings for the Catalonian entity, surpassing, for the first time, €600 million. According to the Economical Vice-President Susana Monje, club’s finances were passing through “the best time in their history”.

But we reached the month of January and a surprise popped up when Barça came out unable to complete the signing of Nolito, the only explicit request from the coach for the winter transfer window. Barcelona limited themselves to offer Celta the possibility to bring the player on loan until the end of the season, and then proceeding to sign him or paying a €3m compensation in case of not closing the deal. The Vigo team’s board didn’t accept the proposal, because they were only willing to let their star player go for a full pay of his €18m buyout clause. And even when some media are resurrecting the transaction in preparation for the summer, the only certainty is that Nolito stayed in Vigo. Reaching this point, many culés were left wondering how was it possible that Barcelona couldn’t face a relatively modest transaction, even more after a glorious season, a record in income and having €76m available, according to the club’s economic record.

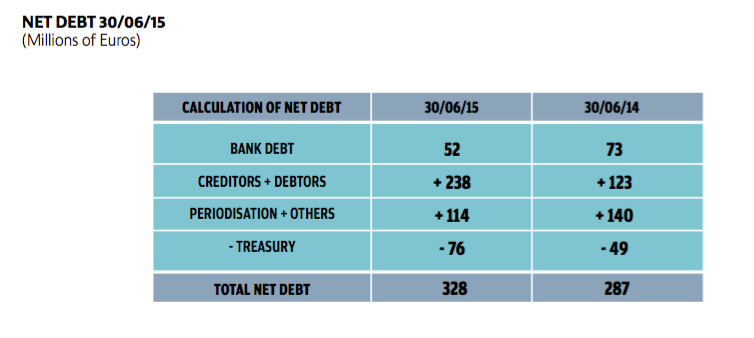

In spite of what some analysts claim, what limits Barça’s margin of maneuvering as of today are not the financial fair-play rules stipulated by UEFA, but a modification in the club’s statutes started by Sandro Rosell’s Board according to which the ratio resulting of dividing the net debt by the EBITDA (Earnings Before Interests, Taxes, Depreciations and Amortizations) has to be reduced progressively until 2.5, having 2.75 as a theoretical limit for 2014/2015 season. As the real numbers showed a ratio of 3.24, way higher that the allowed maximum, the current board must correct that deviation quickly if they don’t want to be forced to resign and call for new elections, as the statutes declare.

If the problem relies in this statute modification, did Rosell’s Board shoot themselves in the foot and are now damaging Bartomeu’s one? The answer is no. The fact that such measures limit in a specific way Barcelona’s financial options in the market doesn’t deny the ultimate utility of it, because it basically manages to assure that no Board can ever leave the club with a debt that’s impossible to assume. On the other hand, not signing of Nolito is nothing more than an alert about how the sportive success of the club is being financially managed, a warning that pushes us to dig deeper in the analysis of the different factors that play a part in said ratio: club’s EBITDA and debt.

Regarding the main sections that are included in the results of operations (the famous EBITDA) of 2014/2015 period, it’s worth highlighting that the increase in marketing earnings that come, mainly, from the bonuses paid by the sponsors for achieving the treble, but also from the contracts signed with Beko and Telefónica and the improvement of other minor contracts (Audi, Damm, la Caixa), was not enough to compensate the increase in sporting salaries coming from the bonuses paid to the players, but also from the liquidation of Xavi and the renewals of Busquets, Alves, Pedro or Sergi Roberto. That’s why, even with an increase in earnings, the resulting EBITDA was 11M€ less than in the 2013/2014 period.

When this worsening of the EBITDA is added to the increase in net debt, caused mainly by the payments of some of the signings made during the season (Suárez, Bravo, Mathieu, Vermaelen, Arda Turan and Aleix Vidal), the result is that the safety ratio established by the statutes sky rockets.

With all this, the club’s executives say they’re calm because they foresee an improvement in the numbers for the current season that would allow them to get close to the 2.5 ratio of net debt vs EBITDA. This is planned to be achieved, on first hand, thanks to an increase in income that would reach €633m, coming from a raise of €25M regarding marketing contracts. A very ambitious goal that’s getting badly complicated after the stalling of the negotiations for the shirt sponsors and not having exploited yet some new ways already taken by other clubs like stadium naming rights or the exploitation of the training shirt.

Regarding expenses, the prediction is an increase, lower than the one on earnings, thanks to the restraining of sporting salaries. But with Neymar’s (and Busquets’) renewal on the table, the predictions of salary restrictions are less and less optimistic, even less if we take into account that the budget is built under the assumption that we only have to pay bonuses after winning the league title, when the team is already in the Spanish Cup final and could even dare to repeat the treble. In this case, they could only achieve the announced balance if the bonuses received from the sponsors completely compensate the ones paid to the players. If that’s not the case, besides getting worse results than the predicted ones, the risk of breaking the financial fair-play rules for excess on salaries would be taken.

Even if the board’s predictions regarding earnings and expenses are achieved, in order to achieve the goal of a 2.5 debt/EBITDA ratio established for this season, they should also reduce the net debt to €300m. Assuming that the pace in bank debt reduction is kept, thus implying that the expenses in new signings can’t exceed what is earned by selling players plus the income that becomes available after the payment of pending debts for previous transfers. And that’s the reason why Barcelona decided not to risk it by paying Nolito’s clause in January: the sales of Pedro and Adama Traoré compensated Arda’s signing back at the beginning of the period, but it wasn’t possible to make new sales during the winter transfer window to cover the expenses of paying Celta’s forward’s clause.

This analysis lays the real short-term challenge for the current board on the table, way beyond his judicial sailings and the eventual financial impact these may bring. They have managed to build a squad of huge quality, complementing Messi with some luxury squires like Luis Suárez and Neymar to form the best attacking trio on history and thus extending the period of success that started with Laporta’s board and the arrival of Ronaldinho. But the cost of such a squad is equally huge, and with the imminent renewals of Neymar and Busquets (and those to follow), the salaries will not stop growing. The millions are on the pitch and are resulting in excellent performances, but it’s necessary to turn those sportive successes in new incomes that grow in a faster pace than the roster’s cost. In case of not achieving it, there would be no other choice than to releasing the ballast, in other words, letting some of the heavyweights go, be it from the main team or from one of the affiliated sections (basketball, handball, hockey, and other teams) in order to not risking the club’s economic viability. A price that no affiliated member is willing to pay in good terms.

You can find an extended version of this article in Spanish, including an analysis of the economic growth potential of the club, in the next issue of The Tactical Room, the magazine of Martí Perarnau.

Anything wrong? Send your correction.

Barcelona News 24/7

Barcelona News 24/7